Portland, OR, September 22, 2021 – Williston Financial Group (WFG), a Portland-based, full-service provider of title insurance and real estate settlement services for commercial and residential transactions nationwide, has released the findings of its 2021 survey of WFG Executive Roundtable members and other industry leaders, and the results signal a marked increase in concern over the impact lengthy turnaround times are having on real estate transactions.

Conducted in June and July of this year, the survey askedmortgage lending executives from community banks, credit unions, bank and non-bank lenders, as well as members of the WFG Executive Roundtable to identify the biggest operational challenges facing the industry. A list was provided, along with a free-form fill-in option, from which they were to select the top three operational challenges they feel are most severe.

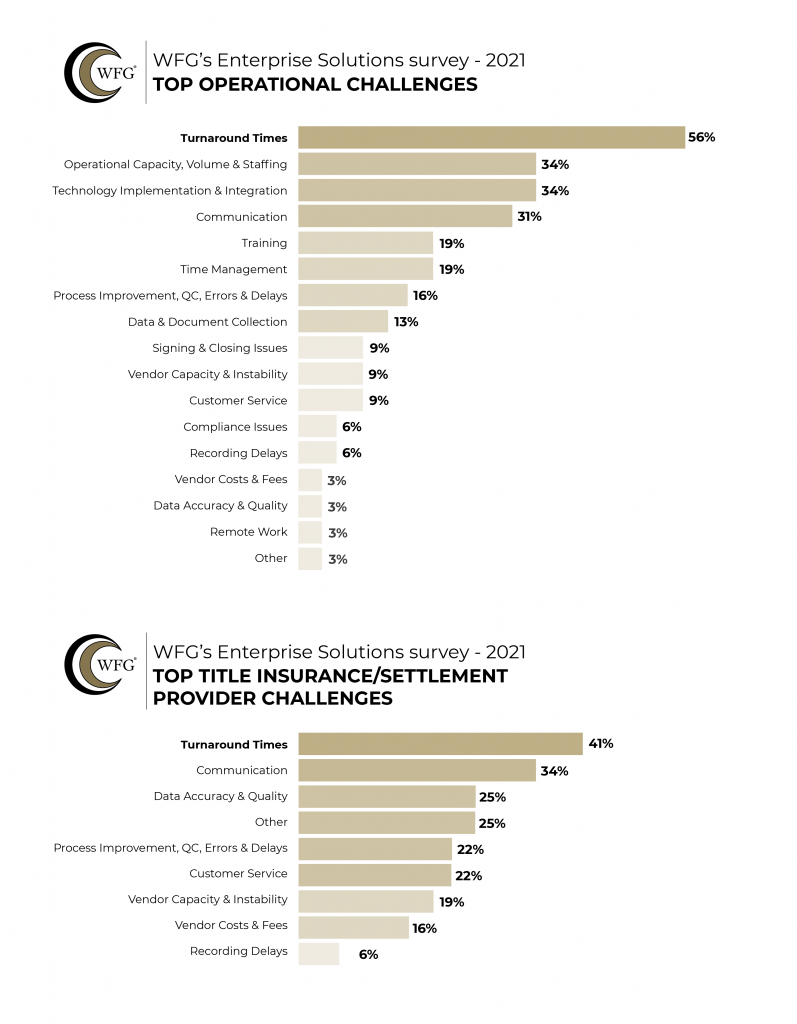

Topping the list was “turnaround times,” which 56 percent of respondents selected. In WFG’s first survey, taken in fall 2020, only a quarter of those surveyed chose turnaround times as a major challenge.

The other most concerning operational challenges were: Operational Capacity, Volume and Staffing (34%), which tied with Technology Implementation and Integration (34%), followed by Communication (31%), Training and Time Management (both at 19%), and Process improvement/QC/Errors & Delays (16%).

Regarding title and settlement, the chief concern identified by those surveyed was again Turnaround Times (41%), followed by Communication (34%), Data Accuracy & Quality (25%), and Process Improvement/QC/Errors & Delays and Customer Service (both at 22%).

“This feedback from the industry is leveraged to help us develop products and services that align with, and help solve these challenges for WFG’s mortgage-lending partners,” said Dan Bailey, Senior Vice President of WFG’s Enterprise Solutions and Lender Services divisions.

Specific lender-centric products that have been developed by WFG’s technology subsidiary WEST, a Williston Financial Group company, based on this broad-based interaction include the company’s award-winning DecisionPoint® instant title decision engine, WFG’s MyHome® consumer collaboration portal, and the Valutrust platform, which facilitates the order, tracking and delivery of WFG’s title and closing and property valuation offerings.

“Since our founding in 2010, WFG’s mission has been to take time and cost out of the real estate transaction for all participants,” said WFG Executive Chairman and Founder Patrick Stone. “In keeping with this purpose, we strive to proactively communicate and collaborate with our clients to develop solutions that address their most pressing operational concerns, enhance operational efficiencies and elevate the customer experience.”

“Our slogan, ‘Because of YOU,’ is a constant reminder that we exist only because of the relationships we maintain with customers and the colleagues with whom we ‘Communicate, Collaborate and Co-exist,’” Stone added.

“This collaborative development process ultimately leads to a better borrower and customer experience,” Bailey said. “And, a major benefit along the way is the potential for vastly improved efficiencies within lender operations.”

For more information about WFG and its services and solutions for mortgage lenders, visit www.wfgls.com, email about@wfgls.com or call (877) 274-3850.

About Williston Financial Group

Williston Financial Group (Portland, Oregon) is the parent company of WFG National Title Insurance Company, WFG Lender Services, WFG Default Services, ValuTrust Solutions, LLC, WEST and other title, settlement and technology solutions providers. It is one of the fastest growing national title insurance and settlement services providers in the mortgage and real estate services industry.

MEDIA CONTACT:

Darcy Patch

VP Marketing, Enterprise Solutions

dpatch@poweredbywest.com

714-305-0136