Almost every day we receive news of yet another commercial real estate property trading for amounts well below its prior sales or appraised values. Despite the attention-grabbing headlines, these transactions indicate to me that someone sees the opportunity to create value by investing in them.

Let’s consider some of the macro issues affecting the commercial market in the second quarter of 2024.

It has been 27 months since the Federal Reserve made its initial interest rate increase in March 2022; the first increase since 2018. Their final increase took place a year ago, in July 2023. Thanks, COVID. During the last four rate-hike cycles, the average time between the final rate hike and the first cut was nine months. If you look back beyond the last four rate-hike cycles, the average timeframe between the final rate-hike and the first cut was even shorter than that. We are now officially beyond the recent historical average.

Looking back to the end of 2023, many economists had predicted that the Fed would cut interest rates several times in 2024, which is not surprising given the historical averages. But that hasn’t materialized. Wall Street and economists seem to hang on to every word from Chairman Powell, and the recent consensus is that the central bank is getting closer to lowering rates. We shall see.

The Fed is monitoring inflation, the labor market, and presumably many other factors to help guide its policy decisions. So, what’s happening with these indicators?

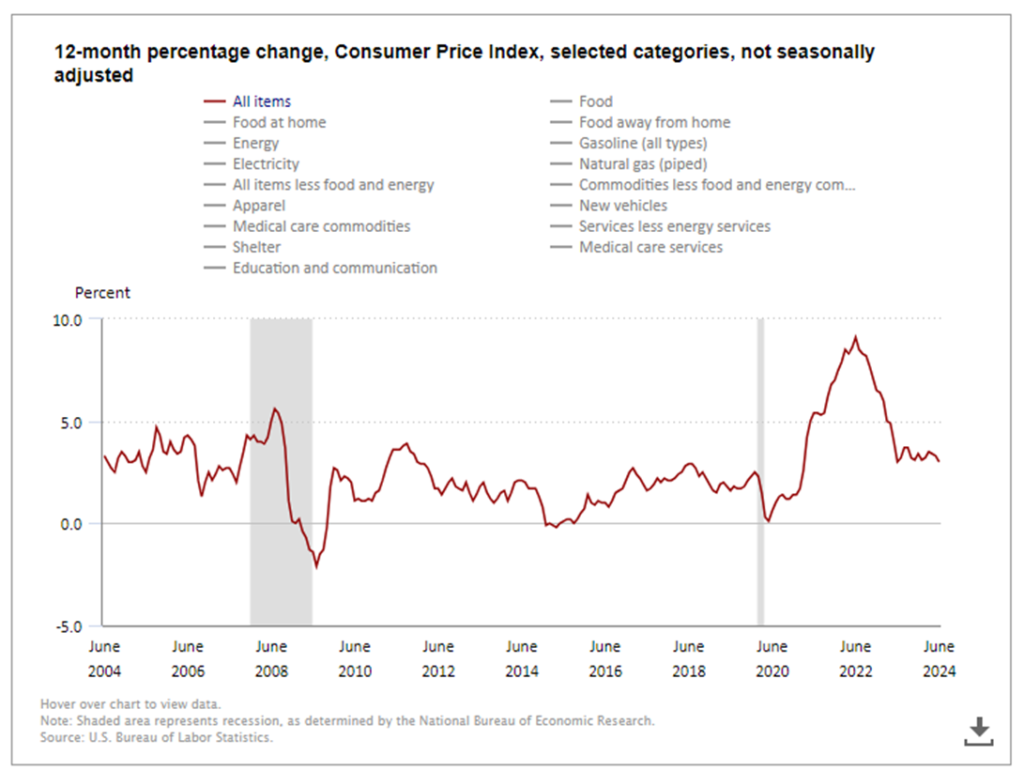

Inflation data for June 2024 reports that the annual rate is at 3% and slightly lower than that on a monthly basis. This is the first time this has happened since the pandemic. So, inflation continues to cool from the 9.1% high of 2022 but has not yet slowed to the self-reported target of 2% needed to justify a rate cut.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

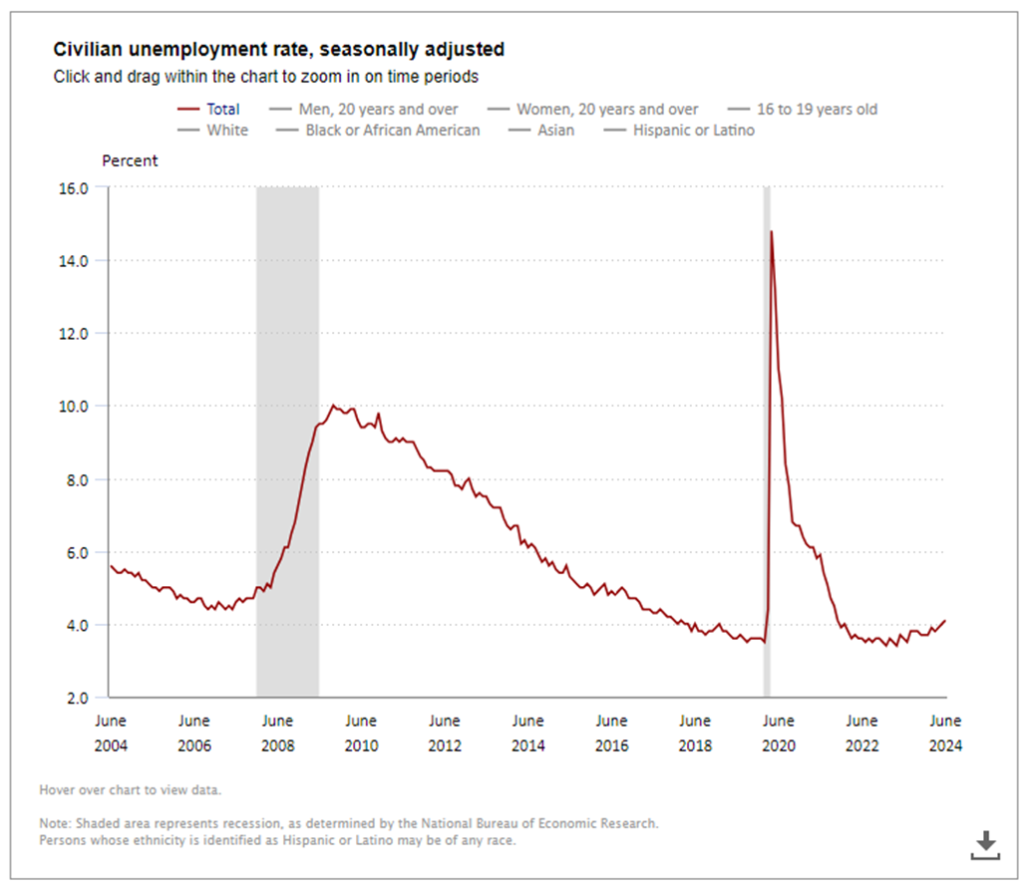

The new labor market figures are out, and according to the Bureau of Labor Statistics, non-farm payroll increased by 206,000 in June, but estimates for the prior two months were revised down by a combined 111,000 jobs. The unemployment rate increased to 4.1%; the highest level since November 2021, signaling a cooling of the labor market.

https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

So what does all this mean for the commercial real estate market? It seems that the industry has for now accepted the “higher-for-longer” rate environment and has been trying to sort things out by working through modifications instead of refinancing, taking advantage of decreased values, converting office space to residential, etc. Some are now saying that values may be nearing the bottom. The inflation and labor market figures seem to indicate that interest rate cuts may be coming after all. When that happens — excluding any potential impact stemming from the election or geopolitical instability – CRE activity should experience some beneficial tailwinds.

The timing of this lift is uncertain, however. With rate declines, there is an accompanying expectation of downward pressure on the cost of capital on CRE. Lenders should get more active in the commercial lending space as a result, signaling to investors that it’s time to get back in the market and deploy those large capital reserves that have been waiting on the sidelines. Additionally, the $ trillions of looming commercial debt maturities coming due through 2026 should perceive some opportunity to refinance at more attractive rates.

In short, a rate reduction for the CRE market should create a sense of general optimism and signal that no further rate-hikes are on the horizon. When this occurs, it’ll be time to pick up the pencils again.