Entering the first Quarter of 2025 we found ourselves in an evolving economic landscape that presented opportunities and challenges for the commercial real estate market. We had expectations of economic growth, multiple interest rate cuts and progress on inflation. There was a general sense of optimism, particularly among small business owners, as the new administration came into Washington and was getting its footing. The agenda included policies which purported to lead to job creation for domestic industries such as energy and manufacturing, speeding development by reducing regulations and promoting productivity. Great ideals which helped stimulate stock market growth until about midway through the quarter. Since mid-February the stock market has declined due to heightened uncertainty caused by the new administration’s policies on tariffs (and overall foreign policy), persistent inflation causing the Fed to maintain rates and hint at a more hawkish policy on future cuts, and concerns about slowing global growth, etc.

Consensus is that the commercial market, which saw a slight recovery in Q4 2024 and continued upward trends in the first quarter of 2025, will continue to see improvements in the remainder of the year.

The return to office trend, which started last year in earnest, has had a positive impact on the office sector and net absorption. Not enough to move absorption into the positive, but enough to see the trend continue in the right direction with rent growth ticking up. Dare I say we are past the bottom for the office segment? It’s still early, but some metro areas saw gains in absorption in the last quarter. We aren’t out of the woods yet, as vacancy rates remain elevated and DOGE dispositions could have a negative effect. Clearly the employee-employer power dynamic has changed since the start of the pandemic, and this bodes well for the future of the office segment.

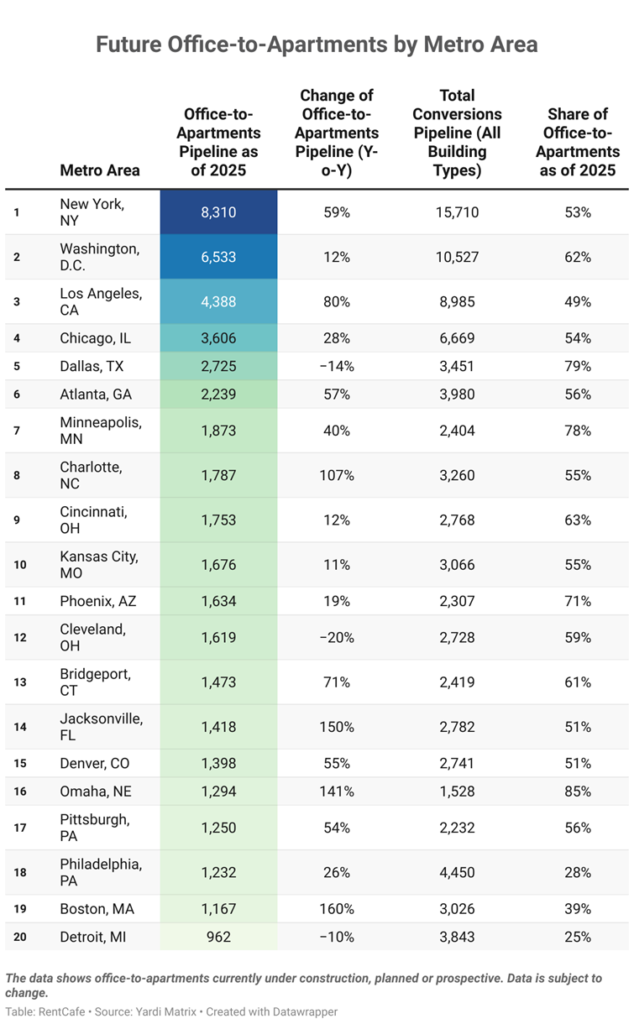

With office vacancies remaining high and a nationwide housing shortage, office-to-residential conversions continue to gain momentum.

In the retail segment, vacancy rates continue to be relatively low nationwide. The return to office trend could positively impact retail in major business centers. Recent closures of major chains has opened up new retail space availability. This is all positive, since construction of new retail has been constrained in many metro areas. This has helped increase rents and, as this trend continues, developer returns are likely to improve for new construction and many areas could experience a retail growth cycle.

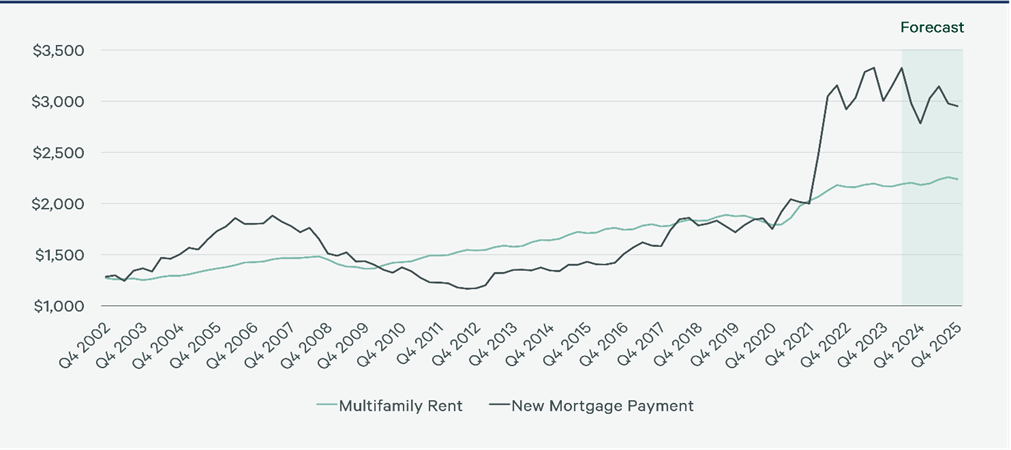

Multifamily has experienced a period of expansion, and the continued affordability issue of residential mortgages along with a limited supply of available homes has made multifamily development the darling of recent periods. Some metro areas have crossed over into oversupply, but demand is expected to continue through 2025.

Average Monthly Multifamily Rent vs. New Home Mortgage Payment Forecast

Investors continue to have confidence in the hospitality market, but rising costs and uncertainty from global trade tensions are producing possible headwinds. Hotel transaction volume didn’t recover from the pandemic until the fourth quarter of 2024, during which we saw increases in transaction volume. According to the CBRE 2025 Hotel Investor Intentions Survey, 94% of respondents plan to maintain or increase their hospitality investments in 2025. Occupancy rates have rebounded and are predicted to be above 63%, approaching the pre-pandemic levels. High-end resort development demand remains strong, highlighted by the commitment by Loews Hotels & Co. of $1B to develop 2,000 new hotel rooms in Orlando in Partnership with Universal.

There have also been a few residential conversions of underperforming hotel properties. Recently the Waldorf Astoria in New York, one of the most iconic hotels in the world, opened for residents after a long conversion process to convert it into high-end residences.

As the first quarter of 2025 came and went, we had a guarded optimism and the commercial real estate market seemed poised to continue to see improvements over 2024 performance. Overall, the broader market has been overwhelmed by the new tariff announcement. Near-term economic data will probably be bumpy, however I am still confident we will see positive trends for the rest of 2025.