Looking back a year, did we get it wrong in Q4 of 2023? We were looking at the possibility of six rate cuts from the Fed, which were then priced into the market, and we didn’t see the first one until September of 2024. Then, when the rates were cut, the 10-year Treasury did the opposite of what economists predicted. Digging into the data, we find that inflation proved to be a little stickier than the Fed anticipated and that the overall economy was showing signs of strength, both constraints to desired and expected rate cuts.

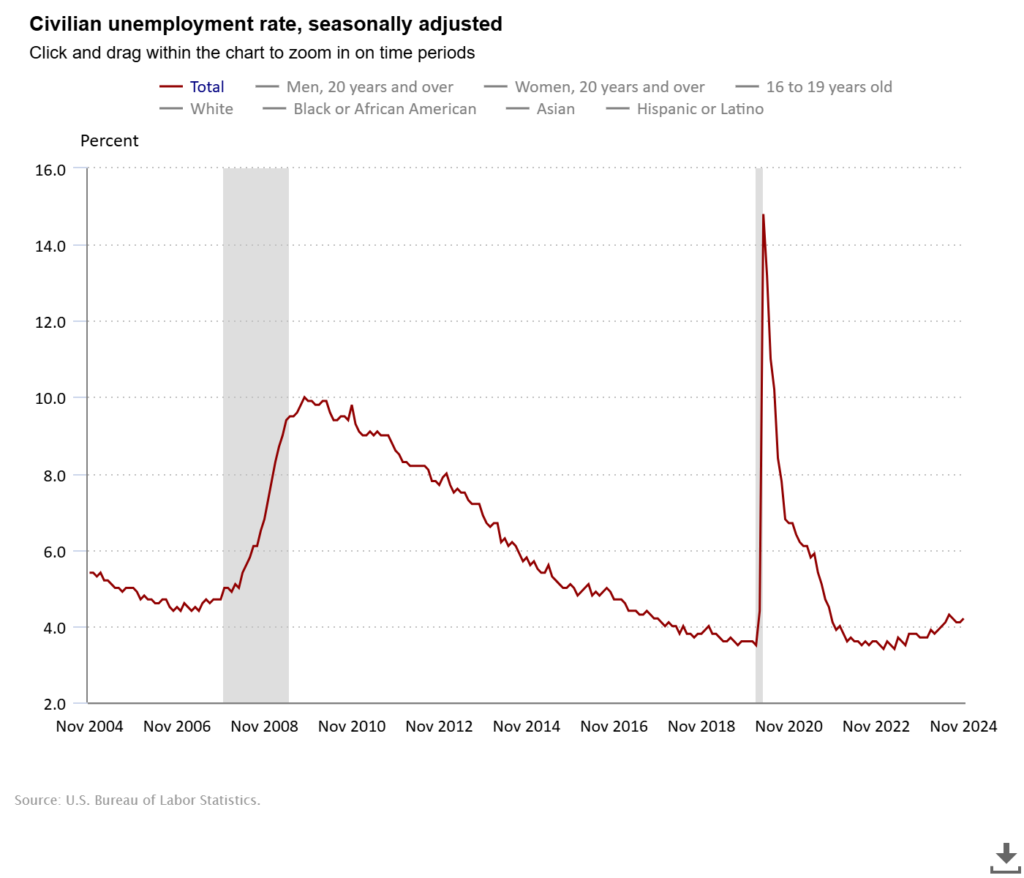

Inflation continues to be above the Fed’s 2% target rate, sticking at 2.7% in November 2024, and there is some debate about the underlying strength of the labor market. The unemployment rate continues to be historically low but has been creeping up slowly in 2024.

Let’s focus on the mortgage, commercial bank, and CMBS rates. How are the current loan rates determined? Typically, the loan rates on mortgages and commercial loans are based on the U.S. Treasury rate plus an additional margin to compensate the lender or investor for the risk associated with the loan (among other factors). Therefore, when the US Treasury rate increases, it puts upward pressure on loan rates. So, why is the 10-year U.S. Treasury rate increasing if the Fed has reduced the fund rate multiple times this year? The answer is bond investors. They require higher yields because the underlying inflation hasn’t come down as much as anticipated and there isn’t confidence that it will. With higher inflation, bond interest payments have less value over time. Another factor affecting the U.S. Treasury bond rate is the anticipated rate of return when selling before maturity. If market demand is weak for Treasury bonds, the price falls, which adjusts the yield upward. The higher yield can also influence broader Treasury rates, as similar bonds will tend to trade at the new rate. With the Fed cautioning against future rate cuts and the possibility of the Treasury issuing more bonds to fund our ever-increasing government debt, it’s hard to make the case for a rate drop.

What does all this mean for the commercial real estate market? Chairman Powell stated in December that future rate cuts for 2025 will now be down from four cuts to two. This announcement leads most to believe the return to 2% inflation will take longer than expected. Similarly, rates will continue to fall in 2025, but slower than anticipated. Macroeconomics, interest rates, and their combined impact on commercial real estate are all complex issues.

The continued increase in CMBS loan delinquencies is an area of concern. According to TREPP, the CMBS delinquency rate rose by 17 basis points in December 2024 to 6.57%. The office delinquency rate rose 63 basis points in December to 11.01%, the highest mark since TREPP began tracking delinquencies in 2000, and more than $2 billion in office loans became newly delinquent in December 2024. Twelve months ago, the office delinquency rate was 5.82%. I can’t say this surprises anyone aware of what’s happening in the office market. The recent trend of companies requiring employees to return to the office may abate this somewhat. Expect more of this in 2025.

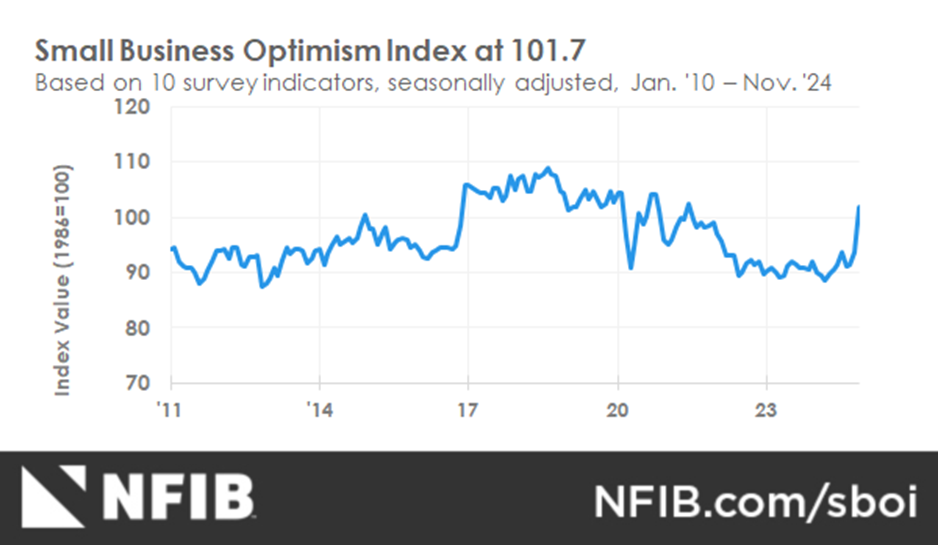

Another thing to consider is the small business optimism index. The recent election has changed the optimism index, which rose to more than 100 after 34 months of remaining below the 50-year average of 98. The anticipation is that with the new administration comes a shift in economic policy that is more pro-business and which favors economic growth.

This increase in the index implies that favorable economic conditions lead to a strong economy, increasing demand for commercial real estate and resulting in higher valuations and increased investments. We saw an increase in overall commercial real estate transaction activity in the closing months of 2024, which we would idealistically like to see continue into 2025. These commercial real estate “green shoots” are a welcome sign.

Looking back to the beginning of 2024, we were optimistic that the rate cuts would come quickly and be numerous enough to facilitate increased activity; however, that didn’t pan out as expected. Despite some challenges and unknowns, there is optimism that 2025 will see more transaction volume than 2024.